What changes for hellotax clients? Basic foodstuffs eg. It is also the largest stimulus package in Europe. More on this topic.

Belgium: 21%: €50: Bulgaria: 20%: 2BGN: Croatia: 25%: 7HRK: Czech Republic: 21%: 0CZK: Denmark: 25%: 3DKK: Estonia: 20%: €38. Finland: 24%: €40: France: 20%: €175. A reduced tax rate of 7% applies e. The lower, down to per cents rate not applied in RC industry.

This measure is said to cost the government around EUR billion, and is by far the largest measure adopted. That’s pretty simple. If not — if you’re VAT-registered in any other EU country — then you only collect taxes on B2C sales. You need to fill in two fields.

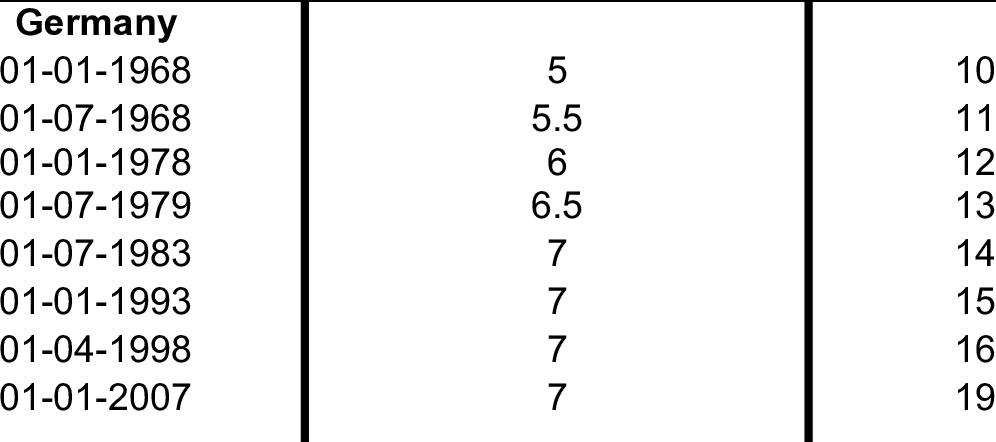

Do not fill in the curren. Germany : 16% 19% 5% 7%. Organizational need for action. VAT % and price - and get pre- VAT price as result. Pre- VAT price and price are rounded (two digits). VAT rates of 16% and 5% respectively. VAT Calculator vat -calculator. This is currently only a political agreement between parties with legislation still to be passed. However, there is also a reduced rate of 7%. The reduction shall be valid from 01.

It is possible to apply for a permanent time prolongation of one month which requires a special prepayment. Rates – Rates are progressive up to 45%. A solidarity surcharge of 5. Bavaria and Baden-Württemberg) are levied on the income tax.

The tax rate varies from 7% to 50%, depending on the value of the inheritance. A further mesure is the postponement of the payment deadline for Import VAT to the 26th day of the following month. The rate of VAT is set according to the parameters of the European Union Value Added Tax system. The EU VAT Directive applies to all member states of the EU and requires them to incorporate it into their laws.

The statutory rate is 25% (275%, including the solidarity surcharge) unless the EU interest and royalties directive applies or the rate is reduced under a tax treaty. Process of VAT number registration is maintained by the federal states (Bundesländer). Value added tax ( VAT ) is payable on sales of most goods and services.

On this page, you will find the standard rates for VAT. Some sectors and areas have specific rates for VAT. Some services (such as bank and health services or community work) are VAT exempt. Import VAT is charged on the value of the goods plus transport costs, customs duties, consumption tax and costs of transport within the EU.

This VAT is charged at the general rate of 19% or, in specific. There is no draft bill at the moment, but the scheduled parliamentary sessions would allow for a respective law to pass the legislative procedure in time.

This clearly puts enormous pressure on. Decisive for the application of the lowered rate will be the date when the supply takes place. Member states must adopt EU VAT Directives into their own legislation. Standard VAT Rate : 19%.

Reduced VAT Rate : 7%. Registration Threshold. Resident - There is no registration. All selling partners should take action now.

Selling partners based outside of the European Economic Area failing to.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.